About Loan Against Mutual Funds..

Loans Against Mutual Funds allow you to borrow money at comparatively low interest rates by using your mutual fund investments as collateral. No CIBIL score is required to apply for this loan.

A loan against mutual funds helps you meet your current financial needs without affecting your long-term investment goals. Your mutual fund investments remain invested and continue to grow while you access the required funds.

Whether the requirement is for a medical emergency, a business opportunity, a family vacation, or any other personal need, you can get funds without redeeming your mutual fund units.

Under Loans Against Mutual Funds, a credit line is set up similar to an overdraft facility. You can withdraw money as needed and are required to pay interest only on the amount used each month, while the principal can be repaid at your convenience.

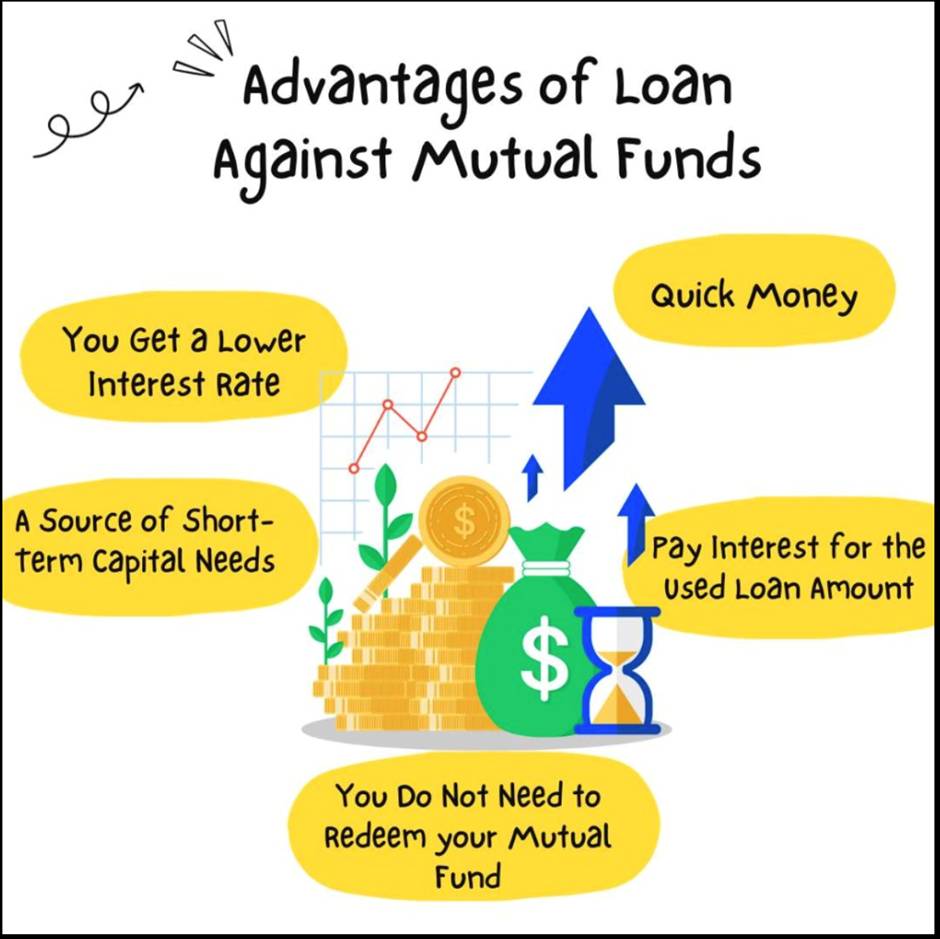

Advantages of Loans Against Mutual Funds (LAMF):

- 💸 Lower Interest Rates – Cheaper than unsecured personal loans

- 📈 Investments Stay Invested – Your mutual funds continue to grow

- ⚡ Quick Access to Funds – Simple and fast processing

- 🚫 No CIBIL Required – Credit score often not mandatory

- 🔁 Overdraft-like Credit Line – Withdraw only what you need

- 🧾 Pay Interest on Used Amount Only – Better cost control

- 🔓 Flexible Repayment – Repay principal anytime

- 🎯 Goals Remain Intact – No need to redeem investments

WhatsApp us

WhatsApp us